TOP 10 WORLD NEWS OF 2007

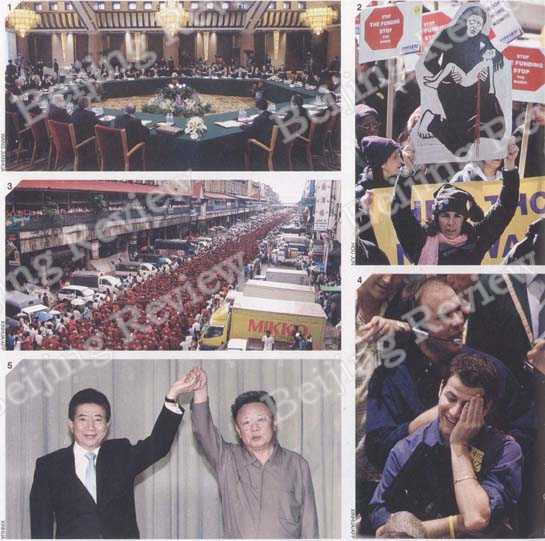

1. DENUCLEARIZATION PROGRESS

The sixth round of the six-party talks on the North Korean nuclear issue opens on February 8 in Beijing. Denuclearization on the Korean Peninsula made great progress in 2007 with North Korea agreeing to disable all its nuclear facilities and provide a complete declaration of all its nuclear programs by December 31, 2007

2. FOUR YEARS OF IRAQ WAR

Protestors hold large-scale demonstrations in New York on March 18 against the U.S. military presence in Iraq. Tens of thousands of Iraqi civilians and more than 4,000 U.S. soldiers have been killed during the past four and half years

3. CONFRONTATIONS IN MYANMAR

Buddhist monks chant prayers of peace while marching through Yangon on September 27. The UN Security Council passed a joint statement on October 11, calling for dialogue between the Myanmar Government and the opposition to end the turbulence in the country

4. SUBPRIME CRISIS

A trader reacts on November 12 at the New York Mercantile Exchange. The U.S. subprime loan crisis, starting in August, has triggered a slowdown in the U.S. economy and has influenced the stability of the world economy

5. SOUTH-NORTH SUMMIT

South Korean President Roh Moo Hyun and North Korean leader Kim Jong II wave to the public after signing a joint statement in Pyongyang on October 4. This was the first summit meeting between the two sides since 2000

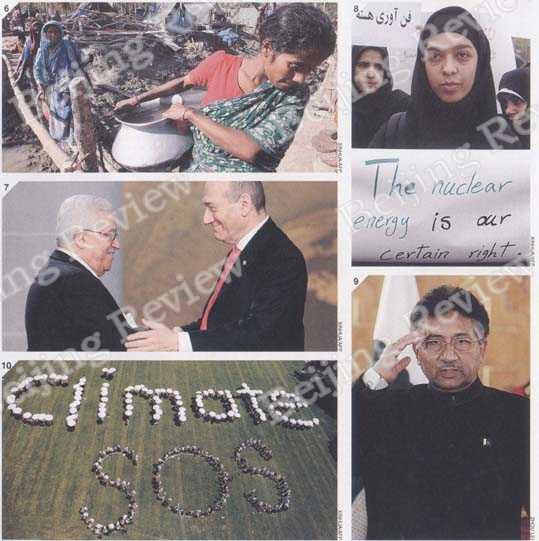

6. LIFE AFTER CYCLONE

A Bangladeshi woman carries a pot of water to her tent in a cyclone-devastated village in the Bagerhat district on November 25. More than 3,400 people were confirmed dead and 280,000 were left homeless by Cyclone Sidr

7. TALKING PEACE

Israel's Prime Minister Ehud Olmert (right) shakes hands with Palestinian Authority President Mahmoud Abbas during the Annapolis Conference in Annapolis, Maryland, on November 27. The two sides reached an initial agreement on realizing peace in the region through negotiations

8. IRAN'S STRONG WILLS

Students hold placards in support of Iran's nuclear program in Tehran on April 9. The United States announced that Iran is still a threat to the world even though evidence showed that Iran had stopped its nuclear weapons research since 2003

9. TAKES OATH AS CIVILIAN

Pervez Musharraf takes the oath as civilian

president of Pakistan on November 29 in Islamabad, after the Pakistani parliament insisted that Musharraf quit the military job. The country still faces challenges with the upcoming parliamentary election in January 2008

10. FIGHT AGAINST GLOBAL WARMING

Environmentalists spell out "Climate SOS" in Auckland on December 8. The global warming situation worsened in 2007 as the world confronted serious weather damage. At the end of the year, nations met to hammer out a new climate pact at the UN Climate Change Conference in Bali, Indonesia

TOP 10 BUSINESS NEWS STORIES 2007

Soaring CPI

Inflationary pressure haunted China all year long in 2007.

China's consumer price index (CPI), a key barometer for inflation, grew 6.9 percent in November year on year, its highest growth rate in a decade.

The CPI growth rate hovered above 3 percent - a recognized international standard to indicate inflation - from March this year and kept accelerating month after month.

The overall CPI growth in the first 11 months stood at 4.6 percent.

This year's CPI surge was triggered by soaring pork prices which grew nearly 50 percent each month compared to 2006. In November, the pork price grew 56 percent, and showed no signs of going down.

Reverberations from higher pork prices soon spread to other food sectors like cooking oil, vegetables as well as fruits.

Foodstuffs have a 33-percent weight in China's CPI and were the major force for the CPI surge.

The producer price index (PPI), another measurement for overall inflation, was up a mild 2.9 percent in the first 11 months.

Monetary Policy Frequently Adjusted

In 2007, China raised the reserve requirement ratio 10 times and interest rates, six times.

The central bank raised the reserve requirement ratio from 9 percent at the start of the year to 14.5 percent as of December 25.

The 10th hike came immediately after the Central Economic Work Conference, which set the tone for the next year's economic development to "follow a tightened monetary policy from the previous prudent one."

The central bank stated that the repeated hikes were aimed at "strengthening liquidity management in the banking system and checking excessive credit growth." It would take diversified monetary measures to cool the economy in the future.

The central bank also raised the benchmark one-year deposit rate from 2.52 percent at the end of 2006 to the current 4.14 percent. The one-year loan rate was raised from 6.12 percent to the present 7.47 percent.

The decade-high CPI forced the central bank to take such actions. The repeated interest rate hikes were also meant to cool down the overheating stock and real estate markets

China Investment Corp. Debuted

China Investment Corp. (CIC), responsible for managing part of China's foreign exchange reserves, began operations this year with senior government official Lou Jiwei as its chief.

The sovereign wealth fund, a Chinese version of the Singaporean Temasek Holdings, was officially set up on September 29. Its aim is to divert the risks of China's ballooning foreign reserve, which stood at $1.43 trillion by the end of September this year - the largest in the world.

In May, the CIC, still in preparation, made its first investment in non-voting shares, valued at $3 billion, in the Black-stone Group, a U.S. private equity firm.

The company has had a total of $200 billion in registered capital allocated from China's foreign exchange reserves. The Ministry of Finance issued 1.55 trillion yuan ($208 billion) worth of special treasury bonds to buy the foreign exchange reserves and inject the funds into the CIC.

One third of CIC's capital will be used to purchase Central Huijin, which now controls China's major state-owned commercial banks; another third to replenish the capital of the Agricultural Bank of China and China Development Bank; and the remaining third to invest in global financial markets.

Foreign Banks Open Branches

China made remarkable achievements in honoring its WTO commitments in 2007. In the five years since

China's WTO accession, operational entities opened by foreign banks increased from 190 to 312.

In April, four branches of foreign-funded banks were locally incorporated and engaged in renminbi retail business, namely, HSBC Bank (China) Co. Ltd., Standard Chartered Bank (China) Ltd., Bank of East Asia (China) Ltd., and Citibank (China) Co. Ltd. More overseas banks are preparing to register their local branches or have filed applications. Most of them registered their China subsidiaries in Beijing and Shanghai.

Once locally incorporated, they are allowed to engage in all foreign and domestic currency business without quota limitations, including offering renminbi services to Chinese citizens. Foreign bank branches can only conduct foreign exchange business and offer renminbi services to corporate and institutional clients. A foreign bank can determine the makeup of its company in the light of its business strategy on a voluntary commercial basis.

QDIIs & QFIIs

China devised two schemes - qualified foreign institutional investor (QFII) and qualified domestic institutional investor (QDII) - to honor its commitments to the WTO by further opening its financial markets.

The QDII scheme, adopted in May, enables domestic insurers, banks and fund management companies to invest in overseas financial markets. It was devised to divert excess liquidity in the domestic market and encourage people to invest in mature markets.

Currently, a total of 16 Chinese and foreign banks, 20 insurance companies and eight mutual fund management companies have been approved by the regulatory departments to invest in overseas markets.

However, the QDII products managed by those companies did not report satisfactory performances due to the volatile international financial markets deeply affected by the U.S. subprime mortgage crisis.

Meanwhile, the QFII scheme, adopted in 2002, made it possible for foreign institutional investors to invest in the mainland financial market. The quota was raised from $10 billion to $30 billion by the end of this year.

To date, a total of 49 foreign institutions have acquired QFII quotas of $9.95 billion, and the value of their portfolio has increased to 200 billion yuan ($26.5 billion).

The two schemes are beneficial to both domestic and overseas markets. When the cross-boarder capital scale is expanded further, the openness of Chinese capital accounts under the international balance of payments will be increased.

Yuan Kept Appreciating

In May, the Chinese central bank allowed the yuan exchange rate to float at a wider range-plus or minus 0.5 percent each day-from its previous range of 0.3 percent.

On December 14, the exchange rate of the U.S dollar against yuan was 7.3589. The yuan appreciated 5.7 percent this year, and it has appreciated 11.08 percent against the U.S. dollar since China reformed its exchange rate system in July 2005.

The yuan's daily permitted trading range had remained at 0.3 percent for two years. It is widely expected the range will be further widened next year.

Loosening on the yuan is an important step forward and lays a solid foundation for the currency's full convertibility.

IPO Rush on the Mainland

The bullish performance of the mainland stock market attracted many overseas listed Chinese companies to launch initial public offerings (IPOs) at home.

PetroChina, which holds the biggest weight in the mainland stock market, made 3 billion of its shares tradable in the A-share market on November 5 after seven years of trading in Hong Kong and New York.

To date, the majority of the Hong Kong and U.S.-listed mainland companies have made their debut on the mainland, such as China Life, Ping An of China, Shenhua Energy, PetroChina, Bank of China and China Construction Bank.

On December 14, the total market value of the yuan-denominated A-share market reached 30 trillion yuan ($4.05 billion), more than three times higher than what it was at the end of 2006.

Overseas Acquisition Fever

Domestic companies were more active in acquisitions in overseas markets in 2007. The wave of overseas acquisitions started in the financial institutions.

South Africa's biggest commercial bank-Stan- dard Bank - announced on December 3 that an overwhelming majority of shareholders had approved the acquisition of a 20-percent stake by China's biggest lender, the Industrial and Commercial Bank of China (ICBC). The deal would make ICBC the biggest shareholder in the South African bank.

Before ICBC hit the road, the China Development Bank (CDB) has become a major stakeholder in London-based Barclays. CDB agreed to pay 2.2 billion euros for a 3.1-percent stake in Barclays.

China Minsheng Banking Corp., the country's seventh largest lender by market value, is the first Chinese bank to be involved in the U.S. banking sector. It acquired 9.9 percent shares worth of about $317 million of UCBH Holdings Inc. - the biggest bank serving the Chinese community in the United States. Minsheng announced plans to buy up to 20 percent of UCBH's shares if conditions permit.

Ping An of China, the country's leading insurer, bought 1.81 euros worth of stocks of Belgium's Fortis NV in the secondary market, which enabled the insurer to be the biggest single shareholder of the bank.

Tax Rebate Cuts

The Chinese Government made its boldest move ever to slash tax rebates this year. This move was part of a basket of measures to rein in its overheated export growth and reduce its ballooning trade surplus.

The new tax rebate policy, effective on July 1, affected 2,831 items which account for 37 percent of all exported products. Among those, tax rebates of 553 items falling into the categories of "energy- and resource-consuming or highly polluting" were totally abolished, and tax rebates on exports of 2,268 commodities that "tend to cause trade friction" were reduced.

Since 2004, China has readjusted its tax rebate policy many times and quickened its attempts at bringing its soaring trade surplus under control.

China-Made Toy Recalls

Starting in June, U.S. importers recalled more than 21 million China-made toys for containing lead paint, loose magnets or cheap industrial solvent.

Most recently, the U.S. Consumer Product Safety Commission recalled 4.2 million China-made Aqua Dots sets on November 8.

However, in fact only 0.9 percent of 3 billion toys sold in the United States each year have been recalled, and the majority of recalls were for design flaws, not manufacturing problems.

Besides this, differences in quality and safety standards are another reason why a considerable proportion of exported toys have come under scrutiny.

In September, Mattel, the world's largest toy company, issued an official apology to China for the design defects and damaging the reputation of China-made toys, which account for up to 80 percent of the toys sold in the United States.

TOP 10 DOMESTIC NEWS OF 2007

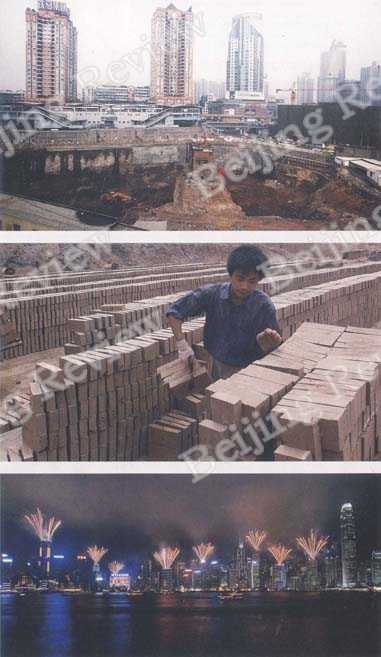

Adoption of the Property Law

China's top legislature, the National People's Congress, overwhelmingly adopted the Property Law on March 16, after a legislation process of more than 13 years. The law, which came into effect as of October 1, 2007, is the first Chinese law to grant equal protection to public and private property.

The photo shows owners of a two-story house in southwestern Chongqing Municipality, unsatisfied with compensation for losing their home, as they battled to stop developers from razing it.

Forced Labor Scandal

A forced labor scandal came to light in June when illegal brick kilns in northern Shanxi Province were found to be forcing kidnapped workers to work 14 to 20 hours a day without payment. Owners of the brick kilns made use of fierce dogs and thugs to prevent workers from escaping. The ensuing nationwide crackdown on unlicensed illegal kilns, mines and workshops rescued over 1,300 people from forced labor.

10th Anniversary of Hong Kong's Handover

A gathering marking the 10th anniversary of Hong Kong's return to China and the inauguration of the third-term government of the Hong Kong Special Administrative Region was held on July 1. Chinese President Hu Jintao attended the gathering and said Hong Kong's success over the past 10 years shows that Hong Kong people are fully capable of managing Hong Kong well and sustaining its growth.

Disastrous Floods in Chongqing

Southwestern Chongqing Municipality experienced its fiercest torrential rain in almost a decade in mid-July. Ensuing floods, landslides and mud-rock flows in one week killed at least 56 in the city and caused direct economic losses of over 3.1 billion yuan ($419 million). By the end of November, floods in China this year had affected 180 million people, with 1,203 people killed. The floods this year also led to direct economic losses of 107.1 billion yuan ($14.5 billion).

Founding of National Bureau of Corruption Prevention

The National Bureau of Corruption Prevention (NBCP) directly under the State Council was founded on September 13. Without power to investigate individual cases, the bureau has been assigned the tasks of pushing forward transparency of government information at various levels, evaluating loopholes in new policies that may give rise to corruption and pushing for sharing of information among prosecutors, police, banks, courts and the NBCP.

Special Olympics in Shanghai

Almost 7,500 athletes with mental disabilities from 164 countries and regions competed at the 2007 Special Olympics World Summer Games in Shanghai between October 2 and 11. As the largest Special Olympics in the movement's 39-year history, it was the first games staged in a developing country and in an Asian country.

17th National Congress of CPC Convened

The 17th National Congress of the Communist Party of China (CPC), which mapped out China's overall development for the coming five years, opened on October 15. Hu Jintao was reelected for his second five-year term as Party chief. The new Political Bureau Standing Committee of the CPC Central Committee, the Party's top leadership, consists of five reelected members and four new faces, Xi Jinping, Li Keqiang, He Guoqiang and Zhou Yongkang.

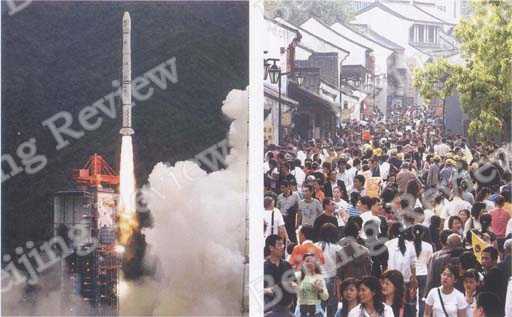

Launch of China's First Lunar Probe

China successfully launched its first unmanned lunar probe, Chang'e-1, on October 24, the first milestone of the country's lunar exploration program initiated in 2003.

Chang'e-1, named after the Chinese Goddess of the Moon, will fulfill four scientific objectives, conducting a three-dimensional survey of the moon's surface, analyzing the abundance and distribution of elements on the lunar surface, investigating the characteristics of the lunar regolith and the powdery soil layer on the surface, and exploring space between the earth and the moon.

A New Vacation Plan Introduced

After a year of deliberation and an online poll, the Chinese Government overhauled the country's eight-year-old national holiday system on December 7. It canceled the weeklong May Day holiday, added three traditional festivals, the Tomb-Sweeping Day, Dragon Boat Festival and Mid-Autumn Festival, as national holidays, and raised the number of public holidays to 11 from 10. A regulation giving people more freedom over when to take their own paid vacations was adopted on the same day.

National Center for the Performing Arts Unveiled

The National Center for the Performing Arts, formerly known as the National Grand Theater, was completed in late September and opened for performances on December 22. The landmark center, which cost 2.69 billion yuan ($364 million) to build, had been a controversial project due to its futuristic design and high cost, since its construction began in December 2001.

Copy Reference

Copy Reference